Little Known Facts About Thomas Insurance Advisors.

Wiki Article

The Main Principles Of Thomas Insurance Advisors

Table of ContentsThomas Insurance Advisors Things To Know Before You BuyUnknown Facts About Thomas Insurance AdvisorsGetting The Thomas Insurance Advisors To WorkThomas Insurance Advisors Fundamentals Explained

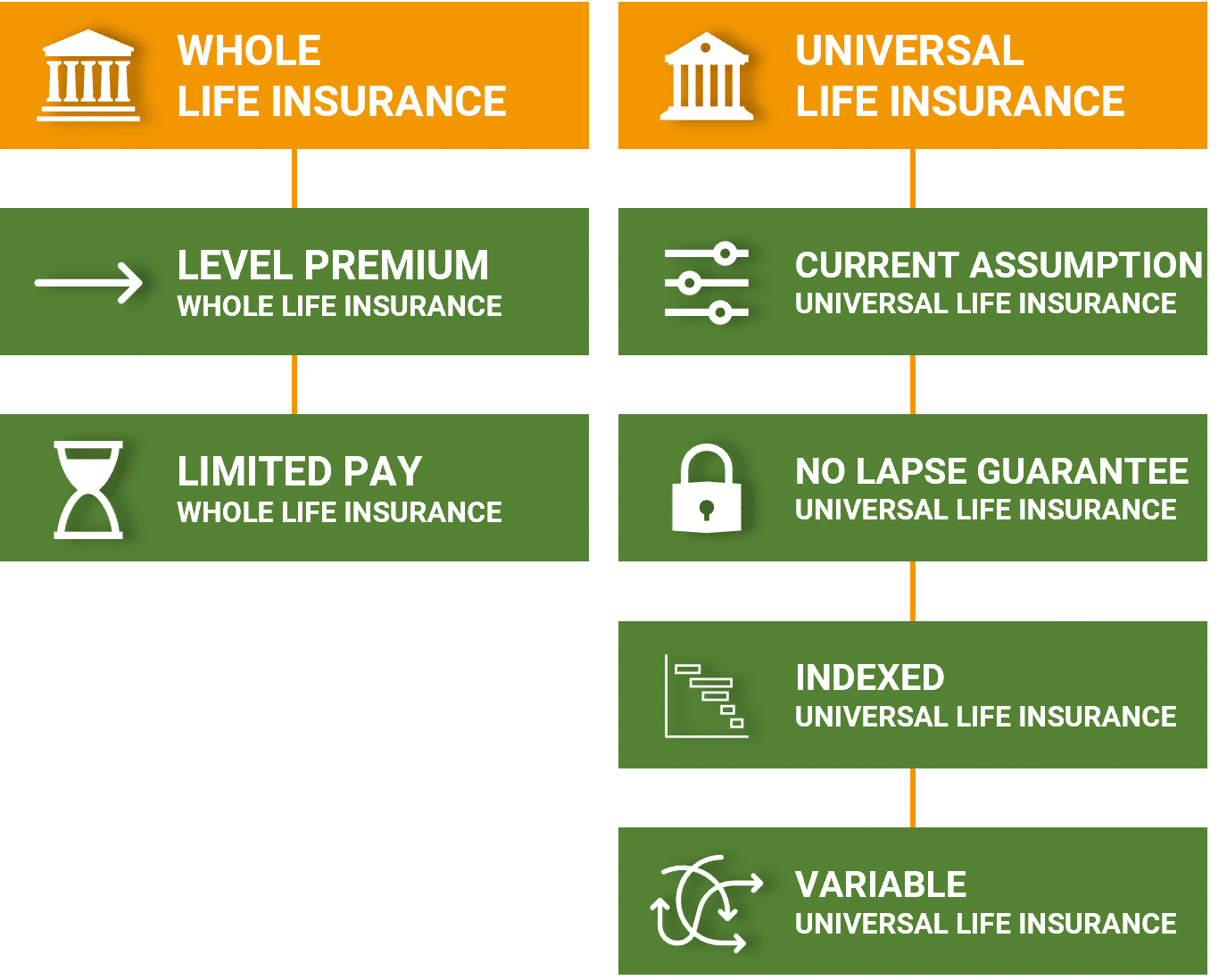

We can't stop the unanticipated from happening, but in some cases we can secure ourselves and our family members from the worst of the monetary results. 4 types of insurance that many economic professionals suggest include life, health and wellness, automobile, and also long-term special needs.Health insurance coverage safeguards you from tragic bills in case of a major mishap or illness. Long-term handicap protects you from an unanticipated loss of earnings. Vehicle insurance stops you from bearing the economic problem of a costly crash. Both standard kinds of life insurance policy are traditional whole life as well as term life.

It includes a survivor benefit and likewise a cash value component - https://www.directorytogoto.com/articles/get-covered-with-thomas-insurance-advisors-your-trusted-insurance-partner-in-toccoa-ga. As the worth grows, you can access the cash by taking a car loan or taking out funds as well as you can end the plan by taking the money worth of the policy. Term life covers you for a collection amount of time like 10, 20, or thirty years and your premiums continue to be steady.

Thomas Insurance Advisors - The Facts

9% of married-couple families in 2022. They would certainly be likely to experience economic challenge as an outcome of one of their wage earners' deaths., or private insurance coverage you buy for yourself and your household by calling wellness insurance coverage companies directly or going via a health and wellness insurance coverage representative.

If your income is low, you might be just one of the 80 million Americans who are qualified for Medicaid. If your revenue is modest yet does not stretch to insurance protection, you might be qualified for subsidized insurance coverage under the federal Affordable Care Act. The best and also least pricey alternative for salaried employees is typically joining your employer's insurance policy program if your company has one.

Investopedia/ Jake Shi Long-term impairment insurance coverage sustains those who end up being unable to work. According to the Social Safety Management, one in 4 workers entering the labor force will become disabled before they get to the age of retirement. While health and wellness insurance spends for hospitalization and clinical costs, you are frequently strained with all of the expenditures that your paycheck had actually covered.

The Ultimate Guide To Thomas Insurance Advisors

Many plans pay 40% to 70% of your income. The price of disability insurance is based on many factors, including age, lifestyle, and health and wellness.Many strategies need a three-month waiting duration before the protection kicks in, offer an optimum of three years' well worth of insurance coverage, as well as have substantial policy exclusions. Below are your check options when buying automobile insurance coverage: Responsibility insurance coverage: Pays for property damage and injuries you trigger to others if you're at mistake for a mishap as well as likewise covers litigation costs as well as judgments or negotiations if you're taken legal action against because of an auto accident.

Comprehensive insurance policy covers burglary and also damage to your automobile due to floodings, hailstorm, fire, vandalism, falling items, as well as pet strikes. When you fund your auto or rent a car, this kind of insurance policy is necessary. Uninsured/underinsured driver () protection: If an uninsured or underinsured chauffeur strikes your car, this coverage spends for you and also your guest's clinical expenditures and also might likewise represent lost earnings or compensate for pain and also suffering.

How Thomas Insurance Advisors can Save You Time, Stress, and Money.

Medical payment coverage: Medication, Pay protection helps pay for medical expenditures, generally in between $1,000 and $5,000 for you and also your passengers if you're harmed in a mishap. Just like all insurance policy, your situations will figure out the cost. Contrast a number of price quotes as well as the coverage supplied, and examine periodically to see if you get approved for a lower price based upon your age, driving record, or the location where you live.Employer protection is usually the most effective option, yet if that is unavailable, acquire quotes from several companies as numerous provide discount rates if you purchase greater than one sort of coverage.

There are various insurance plan, and also knowing which is appropriate for you can be difficult. This overview will discuss the different kinds of insurance as well as what they cover. We will also offer pointers on choosing the ideal plan for your needs. Table Of Contents Medical insurance is among the most crucial kinds of insurance that you can have.

Depending on the plan, it can additionally cover oral as well as vision care. It gives monetary safety for your loved ones if you can not support them.

Report this wiki page